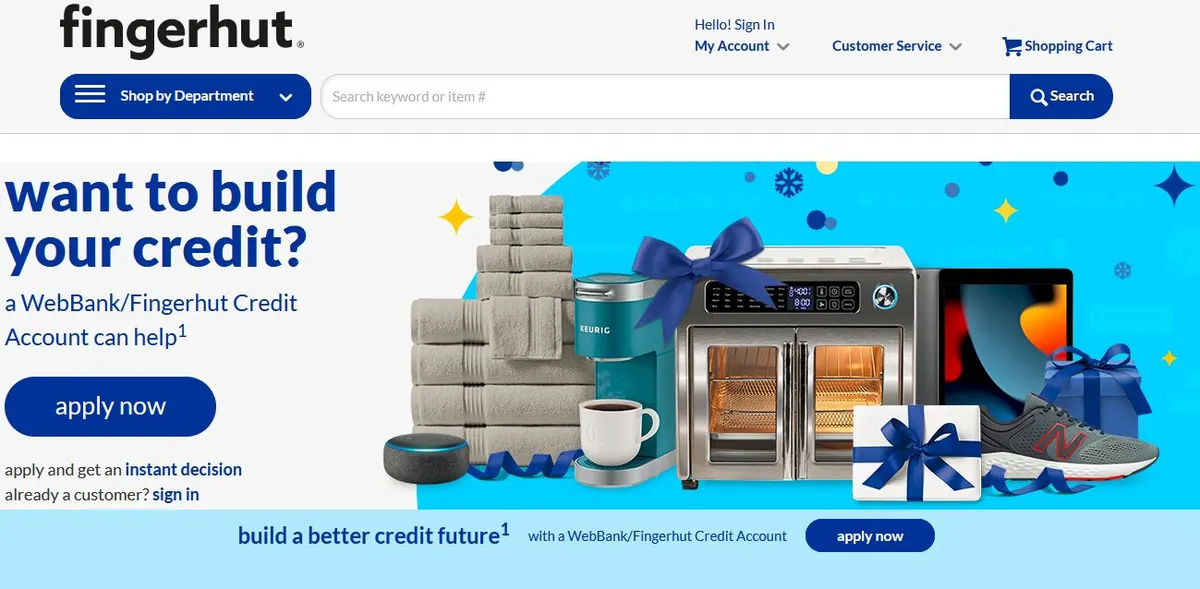

Fingerhut is a unique and convenient choice for customers when it comes to online purchasing. Fingerhut, established in 1948, has evolved into an online store catering to customers and offering a wide array of products and services. This article will go into great detail on Fingerhut, including information about the Fingerhut app, how to log in, credit methods, catalog offerings, and a lot more. Here, we’ll provide you with important information on everything Fingerhut offers, regardless of whether you’re a new user or a longtime customer.

Fingerhut Credit: Easy Purchasing

Fingerhut’s financing scheme is one of its best qualities. Customers with low credit are still able to make purchases on Fingerhut Credit. Everything you should know is as follows:

Fingerhut App and Login:

One of Fingerhut’s digital era developments is an easy-to-use app that improves the buying process. With the Fingerhut app, users can easily explore, choose, and buy products from Fingerhut’s vast inventory on their mobile phones or tablets. The software is compatible with devices running iOS as well as Android. Users have to create or sign into their Fingerhut accounts in order to begin purchasing on the Fingerhut app. You may quickly create an account if you don’t already have one, then take advantage of the ease of shopping while on the road.

Fingerhut Online Store and Catalog:

The Fingerhut online store offers a vast selection of goods, ranging from apparel and electronics to furniture and appliances. Online fingerhut catalog browsing allows customers to choose products that best fit their requirements and preferences. Fingerhut offers numerous payment methods, making it a simple alternative for consumers seeking high-quality items.

Fingerhut Credit & Credit Card:

It has a reputation for giving its clients access to credit alternatives. Fingerhut Credit is a credit line that lets users make purchases and spread out payments. After applying for Fingerhut Credit, customers can obtain a credit line that they can use to make a range of purchases. Furthermore, Fingerhut provides the Fingerhut Credit Card, which is only good for transactions made at Fingerhut. It provides the ease of developing credit and making payments every month while taking advantage of the newest items.

Fingerhut Discount Codes:

Fingerhut frequently provides its consumers with Fingerhut promo codes and special offers to make purchasing even more alluring. If you want to get discounts on your Fingerhut purchases, keep an eye out for such codes.

Fingerhut Fresh Start:

Those with credit records that aren’t exactly perfect might benefit from Fingerhut’s Fresh Start program. For people looking to take Fingerhut advantage of the perks of shopping and raise their credit score, this service can be a useful choice.

The Fingerhut Advantage & Customer Service:

Fingerhut offers outstanding client service to handle any problems or inquiries that clients might have. Committed users of Fingerhut can also take advantage of exclusive specials and deals. Fingerhut’s customer service staff is ready to help if you ever run into problems or have inquiries regarding your orders or account.

Fingerhut Payment:

Using Fingerhut to make payments is easy and flexible. Depending on your preferences and financial position, you have the option to pay more into your Fingerhut Credit account.

The Fingerhut: Pros and Cons

Fingerhut surely has unique benefits, but it also has drawbacks like any other credit and shopping option.

Customer Experience

Fingerhut is committed to giving its customers the best possible experience. Customer service is also a top concern, and there is an entire support staff on hand to help with questions and problems.

To improve the client experience, Fingerhut also provides a number of incentives, discounts, and promotional offers. These programs are meant to increase the appeal and affordability of buying at Fingerhut for patrons.

Effects on the Retail Sector

Fingerhut’s credit-based business model has significantly impacted the retail industry. Fingerhut has established a distinct market by giving credit to clients who would not be eligible for conventional finance. This approach has played a role in making consumer goods more accessible by providing opportunities for individuals with incomes or less than ideal credit histories to access a variety of products.

Conclusion: A Hub for Credit and Shopping is Fingerhut

Since its modest origins, Fingerhut has evolved to provide a wide range of items, financing alternatives, and online resources to improve the buying experience. Fingerhut’s smartphone ease, easily available finance choices, and friendly Fingerhut customer service make it an obvious choice for online consumers. Therefore, it’s evident that Fingerhut provides a full solution for contemporary customers, regardless of whether you’re seeking the Fingerhut catalog shopping experience or are just learning about the Fingerhut advantage.

Frequently Asked Questions (FAQs) about Fingerhut

Q1: What is a Fingerhut?

Answer: A large selection of goods, such as gadgets, appliances, home goods, apparel, and more, are available from Fingerhut, an online retailer. Established in 1948, Fingerhut is renowned for its distinctive credit-based purchasing approach, which enables consumers to make goods and settle the balance over time, especially in situations where access to conventional credit lines is restricted.

Q2: What is Fingerhut fetti?

“Fingerhut Fetti” isn’t a phrase or product that’s specifically related to Fingerhut. It could be a phrase used in slang or colloquialism that has nothing to do with the business.

Q3: How does Fingerhut work?

Fingerhut is an online and catalog shop. To shop for a large selection of items, customers can visit the organization’s website or peruse a catalog. Fingerhut’s credit-based business model, in which it gives consumers Fingerhut credit to make goods and purchase them over time, is what makes it unique. Financing alternatives available to customers include revolving credit accounts, flexible periods, and cheap monthly payments.

Q4: Is Fingerhut good for credit?

For people who are seeking to restore their Fingerhut credit or who don’t have access to regular credit lines, Fingerhut might be a viable choice. Fingerhut provides Fingerhut credit agencies with information about its clients’ Fingerhut payment histories. Customers should be aware of the costs and interest rates related to Fingerhut’s financing alternatives, nevertheless.

Q5: What is Fingerhut used for?

Fingerhut serves as a destination, for a selection of consumer goods encompassing clothing, home essentials, and appliances. Fingerhut is especially well-liked by clients who might have few credit choices since it offers credit to enable them to make purchases and pay for them gradually.

Q6: Where can I use my Fingerhut credit card?

Usually, direct purchases from Fingerhut’s website or catalog are made with this Fingerhut credit card. This isn’t your typical credit card that you may use for everyday purchases or at other stores. The main use of the Fingerhut Credit Account is for purchases made within the Fingerhut network.

Q7: What is Fingerhut called now?

Fingerhut was still referred to as Fingerhut as of January 2022, when I last updated my information. Since then, there could have been modifications or rebranding, but I am not aware of any such activities. If there have been any changes to the company’s name, you might wish to visit their website for the most recent information.

Q8: What is Fingerhut minimum payment?

Answer: Depending on the customer’s selected financing plan and account balance, there are several minimum payments for Fingerhut Credit Accounts. Generally, customers must make monthly payments, with the minimum amount determined by the outstanding debt. It is crucial for clients to verify the precise minimum payment required for their accounts by checking their bills or getting in touch with Fingerhut directly.

Feature image by: fingerhut.com